Tax planning is a proactive approach that enables Irish businesses to maximize profitability, reduce tax liabilities, and ensure compliance with ever-changing regulations. In Ireland’s complex tax landscape, an effective strategy can safeguard a company’s financial health, providing clarity amid evolving rules and reliefs. Recent adjustments in tax credits, VAT rates, and corporate taxes highlight the need for businesses to remain agile and well-informed. Effective tax planning can truly spell the difference between financial growth and unexpected strain, empowering companies to reinvest savings, streamline operations, and stay resilient in a competitive market.

Understanding the Irish Tax System for Businesses

To understand the Irish tax system for businesses, several critical taxes come into play:

- Corporation Tax: Ireland’s standard corporate tax rate for trading profits is 12.5%, one of the lowest in the EU, designed to attract businesses and investments. Companies that earn passive income (such as rental or investment income) face a higher rate of 25%. Ireland also offers specific incentives like the Start-Up Relief for companies during their first three years and R&D credits, allowing eligible businesses to claim a 25% tax credit on qualifying expenditures.

- Value Added Tax (VAT): VAT is charged on goods and services supplied in Ireland, with the standard rate set at 23%. There are reduced rates (e.g., 13.5% and 9%) applicable to certain goods and services such as hospitality. Businesses registered for VAT are required to charge VAT on sales, reclaim VAT on purchases, and periodically file returns. Ensuring compliance with VAT obligations is crucial, as errors can result in significant penalties.

- PAYE (Pay As You Earn) & PRSI (Pay-Related Social Insurance): Employers deduct PAYE from employees’ wages to cover their income tax and USC (Universal Social Charge). They are also responsible for paying employer PRSI, which funds social insurance benefits. Rates and obligations vary depending on employee income levels and job classifications

Together, these taxes illustrate the complexity of the Irish tax system for businesses and emphasize the importance of proper planning and compliance. Leveraging tax reliefs and credits can greatly benefit businesses, but navigating these opportunities requires a clear understanding of the regulations in place.

Common Tax Planning Mistakes to Avoid

Missteps in tax planning can lead to significant financial and compliance challenges for Irish businesses. One common error involves misclassifying business expenses, which can result in incorrect deductions or penalties during Revenue audits. For instance, treating personal expenses as business costs is a frequent oversight that can raise red flags with auditors. Similarly, failing to claim allowable deductions such as capital allowances or expenses for business travel can lead to paying more tax than necessary.

VAT mistakes are also prevalent; these can include incorrect filings, failing to correctly apply reverse charges on cross-border transactions, or not adhering to new VAT rates and rules. Ensuring accurate and timely VAT reporting is critical, as errors often lead to costly fines.

Lastly, during Revenue audits, common errors often revealed include incomplete or inaccurate record-keeping, failure to keep records for the required six years, and under-declaration of taxable income. Avoiding these pitfalls requires proactive tax planning and precise bookkeeping to stay aligned with Revenue’s strict requirements.

Effective Tax Planning Strategies for Irish Businesses

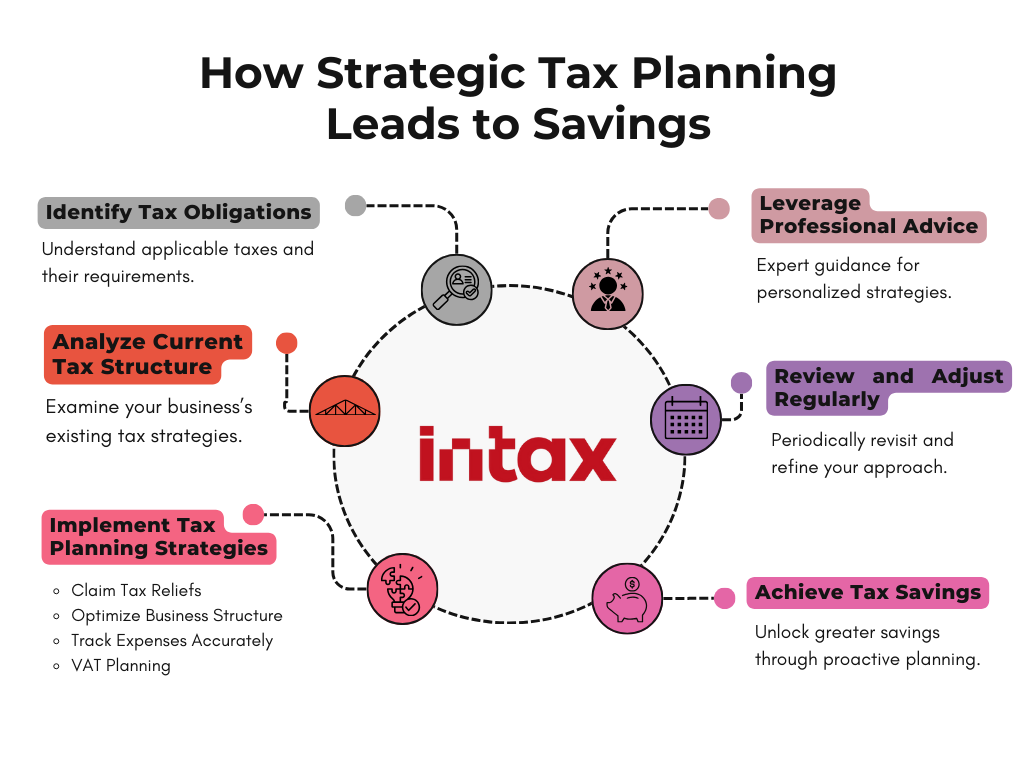

Effective tax planning strategies can make a significant difference for Irish businesses, allowing them to optimize their tax position and reinvest savings for growth.

- Claim Available Tax Reliefs and Credits:

Irish businesses can benefit from several reliefs, notably the R&D Tax Credit, which offers a 25% tax rebate on qualifying R&D expenditures, encouraging innovation within the country. The Employment Investment Incentive (EII) allows companies to attract private investment by offering tax relief to investors, stimulating business growth and economic development. Businesses must meet specific criteria, such as carrying out eligible R&D or being a qualifying SME, to benefit from these reliefs. - Optimise Business Structure:

The type of business structure significantly influences tax liabilities. For example, incorporating as a limited company offers a lower corporation tax rate of 12.5% on trading profits compared to the higher personal income tax rates faced by sole traders. A limited company also provides opportunities to optimize remuneration through dividends, potentially lowering the tax burden on income. Businesses should evaluate the advantages and disadvantages of different structures—sole trader, partnership, or limited company—based on their operational needs and growth ambitions. - Accurate Expense Tracking and Deductions:

Meticulous expense tracking is essential for maximizing tax savings. Deductible business expenses include travel costs, employee wages, office rent and utilities, equipment depreciation, and professional fees. Using digital tools or accounting software helps maintain accurate records, ensuring compliance with Revenue’s guidelines and facilitating smoother audits. - VAT Planning:

Ensuring compliance with VAT regulations while maximizing input credits can improve a company’s cash flow. SMEs may consider using schemes like the Cash Receipts Basis, which allows them to account for VAT only upon receiving payment from customers. Proper planning helps minimize VAT liabilities and avoid penalties from incorrect filings. - Payroll Efficiency:

Managing PAYE (Pay As You Earn) and PRSI (Pay-Related Social Insurance) effectively can reduce administrative burdens and costs. Employers can explore tax reliefs for employee training, bonuses, and other payments to optimize payroll taxes while boosting employee satisfaction. - Use of Tax-Deferred Retirement Accounts:

Investing in pension schemes offers a valuable method to reduce taxable income. Contributions to approved retirement accounts can be deducted from taxable income, and the contributions have favorable tax treatment up to specified limits. This strategy not only helps business owners but also serves as an incentive for employees. - Timing Income and Expenditure:

Strategic timing of income and expenses can significantly impact tax liabilities. For instance, deferring income recognition or accelerating certain expenditures within a tax year can help reduce taxable profits, leading to potential savings. This tactic requires careful planning to align with business cycles and tax deadlines.

Leveraging Professional Tax Advice with Intax.ie

Engaging with Intax.ie can be a game-changer for Irish businesses navigating the complexities of the tax system. We craft tailored tax strategies that align with your business goals while ensuring compliance with Irish tax laws. We possess in-depth knowledge of reliefs, credits, and deductions, helping you identify opportunities you might otherwise overlook.

By mitigating the risk of non-compliance and minimizing tax liabilities, professional advice can lead to substantial cost savings. For instance, businesses have benefited from correctly claiming R&D Tax Credits or optimizing VAT filings through expert intervention.

Case Study Example: A Dublin-based SME faced penalties due to misclassified expenses and late filings. Partnering with Intax.ie not only resolved their compliance issues but also saved them €15,000 annually through restructured deductions and timely filings.

Seeking professional guidance ensures your business stays tax-efficient and audit-ready, allowing you to focus on growth without the stress of tax complexities.

Conclusion: Final Tax Planning Tips for Success

Proactive tax planning is more than a financial strategy—it’s a cornerstone of your business’s stability and growth. By consistently reviewing and refining your tax approach, you ensure compliance, unlock valuable savings, and maintain a healthy financial foundation.

Whether it’s leveraging tax credits, optimizing your business structure, or staying ahead of evolving regulations, an effective tax plan empowers your business to thrive. Regular evaluations and expert guidance are essential to maximizing the benefits of your tax strategy.

Ready to take control of your tax planning? Partner with Intax.ie for comprehensive, personalized tax solutions designed to meet the unique needs of Irish businesses. Contact us today and start optimizing your tax strategy for a more prosperous future!